Those of you, who have been following our blogs closely, would have definitely noticed a key message that an integrated “TRIUNE PURPOSE” driven approach(with its three frameworks -

PDL© for leadership,

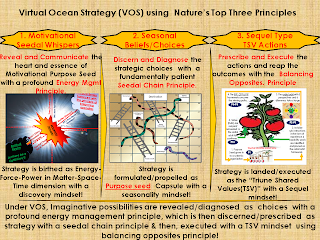

PTV© for strategy and

PIP© for innovation) is the best approach, when it comes to

discovering untapped growth opportunities. While most practitioners would agree with our conclusion, one of the fellow practitioners, made a causal comment during one of the recent networking events - and I quote

-“While it all sounds great to talk about solving these growth opportunities, in an integrated manner, what matters at the end of the day is, financial ratios based business value, and so, everything else is secondary”.

Spiritual Value and Business value – the conjoined twin concepts defined Our friend perhaps has a point as most valuation models, including

McKinsey’s Zen of Corporate Finance Formula, are all based on just three key financial ratios of growth, ROIC and cost of capital. However, as we take a closer look at the six dimensional purpose value chain equation and its elements (spiritual, purpose, leadership, strategy, innovation, scientific as listed in the picture below), we could clearly see a “cause and effect” causal chain relationship, emerging among them, more so, within the triune purpose dimensions of leadership, strategy and innovation. With that said, we contained our enthusiasm (of jumping too quickly into the micro level causal chain analysis), and decided to step back, to define the conjoined twin concepts of business value and spiritual value first- to see how they are interlinked at the macro level -

- Business Value (BV), in its essence, is discounting future cash flows, based on today’s cost of capital, popularly represented using the Zen of corporate Finance Formula, listed below. In other words, corporations not only need to grow continuously, but also, must learn to exercise their investment capital, in a prudent manner, and start producing profitable cash flows, above and beyond the hurdle/threshold rate of WACC, for them to increase their business value -> BV= NOPAT x [(1- g/ROIC)/ (WACC-g)].

- Similarly, Spiritual value (SV), in its essence, is discounting our future heavenly experiences (which happens to be faith & hope driven in most denominations/religions), based on today’s cost of emotional capital (which happens to be love in most denominations/religions), that is expressed using our own version of Zen of Spirituality Formula, listed below. In other words, we not only need to grow spiritually, but also, must learn to exercise our spiritual capital of faith & hope, in a prudent manner, and start living a fruitful life on this earth, above and beyond the minimum threshold of love (or cost of spiritual capital called love), for us to increase our spiritual value -> SV= spiritual gain x (1- Spiritual growth/Return on Spiritual capital)/ (minimum love threshold-spiritual growth).

What do these definitions tell us?

Interestingly enough - very much like how Business value is dependent upon three financial variables of growth, ROIC and cost of capital (or hurdle/threshold rate called WACC), Spiritual value is also dependent upon three spiritual variables of faith, hope and love, and rightfully so, they are interlinked as shown in the picture below -

Spiritual Value is determined by Sustainable Spiritual Advantage (SSA) very much like how Business Value is determined by Sustainable Competitive Advantage (SCA)!

Spiritual Value is determined by Sustainable Spiritual Advantage (SSA) very much like how Business Value is determined by Sustainable Competitive Advantage (SCA)!Now that we have established the six way macro linkages across the six purpose value chain dimensions, the next logical step is to layout the micro linkages among them, with a help of few financial charts, for the benefit of those of us, who chart these things for living. As a first step , let us recall one of the key guiding principles that drives value within our Triune purpose framework (PDL©, PTV© and PIP©) - “For Organizations to increase their business value, they must learn to excel in one or more of following 3C dimensions , to achieve the so called Sustainable Competitive Advantage (SCA)”

- Market/Experience Advantage, as covered within our Experience Pool Portfolio (EPP©) framework, addressing the growth variable within BV formula.

- Capability Advantage, as covered within our Capability Pool Portfolio (CPP©) framework, addressing the ROIC and WACC variables within BV formula.

- Collaborative Advantage or Purpose Innovation advantage, as covered in our Purpose Innovation Portfolio( PIP©) framework, addressing both growth (g)and ROIC variables, as collaborative advantage, in our opinion, is the next wave to unleash growth opportunities, especially within the pull side of the value chain, as covered in one of our earlier articles( http://strategywithapurpose.blogspot.com/2011/01/purpose-innovation-answer-for.html).

Within the context of this 3C formula, SCA would be represented as follows -

- SCA = market or experience advantage + capability or competency advantage + collaborative advantage

Similarly, within the context of spiritual value, we see a similar set of 3C’s, resulting in a Sustainable Spiritual Advantage (SSA) formula as well -

- SSA=faith/hope advantage + love advantage +inter denominational/religion collaboration advantage.

As we further dissect each of the 3C’s within SCA and SSA formulas -we can clearly see a pattern evolving - that the top 5 macro charts, that are being used to develop the diagnostic insights within the SCA and SSA dimensions, not only, follow a symmetrical pattern, but also, they end up becoming the stepping stone for each other’s insight (i.e. SCA and SSA),as outlined in the 15 SCA producing symmetrical charts (5 for Market/Experience Portfolio, 5 for Capability Pool Portfolio and 5 for collaborative Pool Portfolio) and 5 SSA producing symmetrical charts, as outlined below.

SCA enabling Market/Experience Advantage Charts

With that said, let us leverage our EPP framework (that is part of PTV), and analyze the Market/Experience Advantage, with a help of it top 5 macro level bubble charts, with revenue in $ being represented as the bubble. To put our symmetrical progression reasoning in perspective, we have provided a sample set of charts, we recently put together, as part of one of our client engagements, to show how the symmetrical progression is manifested within those charts.

- Company’s growth vs. Market Growth

- Company’s growth vs. Relative Experience or Market Share(RMS)

- Operating Margin (ROS) vs. RMS

- Capital Intensity (or Operating Velocity) vs. RMS

- ROIC vs. RMS

SCA enabling Capability Advantage is analyzed by 5 macro charts within our CPP framework

Similarly, as part of the CPP framework, Capability Advantage is analyzed by 5 macro level bubble charts, with revenue in $ being represented as the bubble.

- Company’s growth vs. Market’s Total capability (primarily capital only for now)

- Company’s growth vs. Relative Capability Share (RCS)

- Operating Margin (ROS) vs. RCS

- Operating Velocity or Capital Intensity vs. RC

- ROIC vs. RCS

SCA enabling Collaborative Advantage is analyzed by 5 macro charts within our PIP and PTC frameworks

Along the similar lines, as part of the PIP and PTC frameworks, Collaborative Advantage is analyzed by 5 macro level bubble charts, with revenue in $ being represented as the bubble.

- Company’s collaborative growth vs. Market’s Total boundaryless collaborative capability (Purpose model, Purpose bundle and Purpose platform etc.

- Company’s growth vs. Relative Collaborative Share (RCS)

- Operating Margin (ROS) vs. RCS

- Operating Velocity or Capital Intensity vs. RCS

- ROIC vs. RCS

Similarly, Spiritual Value is determined by Sustainable Spiritual Advantage (SSA)

Now that we have shown the symmetrical progression existing among the 15 charts from business value producing SCA standpoint, the next steps is to show how they relate to the spiritual value focused SSA. With this article being Business Value focused, we have limited the scope of SSA with just five charts, which hopefully is good enough to show the symmetrical progression from the standpoint of it supporting SCA’s 15 charts and its insights. As time permits, we will go into more details with the remaining 10 SSA charts in one of our future articles. For now, listed below are the 5 macro level bubble charts, with number of souls in # being represented as the bubble, which by the way, happen to be in perfect alignment with the 5 macro level charts of EPP framework.

- Spiritual growth (faith) vs. denomination’s Growth

- Spiritual growth (faith) vs. Relative Denomination/Religion (RDRS)

- ROIC (hope)vs. RDRS

- ROS (faith driven) vs. RDRS

- Operating Velocity (hope driven)vs. RDRS

Does that mean Spiritual Value is the starting point for Business Value?

With that said, I am sure, someone is asking – “does that mean, business value must always start with the spiritual value?” The answer is “IT DEPENDS”, as the spiritual value culture invariably precedes Purpose driven leadership (PDL) culture in most organizations, and so, it is fair to say that PDL can be sourced either from a “higher power” based spiritual leadership culture or from an emotional energy based leadership culture, as long as it has the three key ingredients of faith, love and hope. Nevertheless, our integrated “triune approach” is well positioned to bridge the missing link between business value and spiritual value regardless of the source of the spiritual value (higher power based and/or emotional energy based), as outlined in the picture on the top of the article. It so happens, our PDL leadership framework, equally works well for both realms of cultures i.e. higher power driven spiritual value culture and Emotional energy driven spiritual value culture, as outlined in the picture below as well.

Triune Purpose in action with real world examples…..

With that said, our research also suggests that leaders with a deep sense of spiritual value (or faith), tend to dream bigger visions, regardless of their source of inspiration (i.e. higher power based or emotional energy based) and those big visions are the ones that help them to create those futuristic experience pools (or market segments) which never had existed in the first place, as seen in the following 5 examples from 5 different walks of life-

- Colgate founder William Colgate, a farmer by occupation, venturing into the multi billion dollar Colgate empire, inspired by his Christian Faith –> Spiritual energy based.

- Aravind eye hospital founder Dr.G.Venkataswamy, revolutionizing eye care with a shop floor type business model, inspired by his Hindu faith based Seva Foundation roots –> Spiritual energy based

- Professor Muhammad Yunus, the Nobel Prize winner, founder of the Grameen Bank, and one of the pioneers of micro finance, being inspired by his Islamic concept of charity and faith –> Spiritual energy based.

- Alexander the great, with his emotional energy based faith, conquering most of the known world in his era –> Emotional energy based.

- Steve jobs with his emotional energy based faith, revolutionizing the mobile space –> Emotional energy based.

In all of these five examples, if at all there is a common denominator, it is the fact that these leaders have always started their extraordinary journeys, with a deep sense of faith (higher power based or emotional energy based) and that faith is the one that had eventually helped them to revolutionize the market place or world in a larger context. In other words, in all of these five cases, these revolutionists, ended up creating an experience pool (or market segment), which had never existed in the first place at all. Without going too much into all of their life achievements, let us take the most recent example of Steve Jobs (as he has been in the news a lot lately), and see how his emotional energy driven, faith based vision, helped him to create an experience pool (or market segment) which had never existed before, further reinforcing our triune purpose linkage theme, as shown below.

- Emotional energy driven faith ->big vision->bigger experience pool/market segment which never existed->higher CAGR/ROIC->higher business value

As we further look at Steve Job’s legacy, it is apparent that his “hope and love” part of the emotional energy system was working in perfect harmony with his faith part, every step of the way, especially while he was developing Apple’s futuristic experience pools. In other words, it was his hope part of the emotional energy system that gave him the “never give up” attitude, even when things were impossible for him to climb. Let’s us face it – no matter how we slice it, odds of him reaching to the top of the most innovative company on the face of this planet, were near zero, if not, totally impossible– first growing up in an adopted home, then dropping out of the college, which when was followed by a period when he had to collect soda cans for a single meal, which then was followed by a period of success, and then came the unjust ouster from Apple during his first stint and then the cancer – wow, what a ride! But then, in spite of all of those odds standing against him so high- he neither lost his hope nor his spirits - and in my humble opinion, that is what made him one of the great business leaders of this generation! Not only that, during all those difficult days - he never lost his Mojo or his love for his profession (and to humanity as well) – and in nutshell, he truly lived up to his own slogan – “Stay hungry and Stay foolish”.

Conclusion

In closing, let us conclude with this thought – our combined experience, along with a decade worth of research is showing us that most companies, historically, have succeeded, only when they have taken an integrated approach in discovering untapped growth opportunities. Time and time again, we run into situations, where many “near picture perfect growth strategies” and game changer type innovation plans, have often been put on hold (or stopped?), partly because, appropriate leadership traits, were not exhibited during critical junctures - which makes us to propose another slogan "Lead with the Purpose Culture, Strategize from the Core and Innovate with the Edge". As we further dissect this slogan – we see the following sequence of events happening in any untapped growth discovery initiative, as reiterated further, by our triune purpose driven approach -

- Lead with the PDL leadership framework, to help develop the purpose culture that is needed to set the cultural context and order from the chaos.

- Strategize with the PTV framework, to help establish the boundaries as “Core and Edge”, so that the firm can start strategizing from Core.

- Innovate with the PIP framework, to help innovate without boundaries, yet, with an initial focus of innovating with the edge.

With that said, let us summarize the article with a final quote –

- “THE ME”, one wants to be (Spiritual value) must be aligned with the “THEME” (Business Value), the company wants to be, so that the stakeholders can reap their value, when it is completely THEMED to be!”

The prerequisite for such a magical transformation, is all about us removing the “ME” from the “THE ME” space first and then together transforming it into the “THEMED” place– and that is where, our integrated TRIUNE PURPOSE driven approach, stands tall and bridges that missing link perfectly - as outlined in the picture on the top of the page!