- Shift from “correlation/causality driven imaginative possibilities/choices, represented in the form of novel hypothesis” to the “reverse scenario of imaginative possibilities/choices driving the correlations/causality, that are needed to make the possibilities to come to life”.

- Shift from “designing the tests for the winning choice, after the choice is made” to “designing custom tailored tests for all possibilities ,and let those test results, leading us to the final choice”.

- Shift from “rules guided correlation/causality driven strategy diagnosis/prescription” mindset to “nature’s scientific principles driven causality/correlation driving the diagnosis needed to prescribe the possibilities” mindset.

- Shift from shareholder value (with a CSR component) to Porter’s “Creating Shareholder Value” based value (and now to our firm’s Triune Shared Value (TSV) – as explained in one of our other CapitalismPlus articles).

- Shift from capital economy driven strategy formulation” to “capital/behavioral economics balanced driven strategy formulation”.

- Purpose(or Passion/Compassion) in the form of Motivational/Emotional energies, that get birthed in Heart /Spirit dimension, happens to be the root event for all imaginative possibilities and diagnosis, as guided by nature’s energy management principle -> Energy dimension

- Which then causes Beliefs to get propelled in Mind /Soul dimension, which then sets the nature’s seedal chain principle in motion -> Force dimension

- Which then causes Actions to be landed in Body/Environment dimension by balancing nature’s balancing opposite’s principle, with a "doing both" mindset-> Power dimension.

Simply put, the PURPOSE SEED (that is made up of Vision, Mission, BHAG, Values and Codes), in its essence, is what, germinates into an encapsulated capsule, with this three dimensional MBA causal map. Once this MBA causal map driven purpose seed capsule is framed up correctly, using nature’s top three scientific principles, strategy under VOS, in its essence is just navigating up and down the nodes of the choice trees within this capsule, effectively and efficiently, with an end goal of bringing the imaginative (and yet rational) possibilities to life.

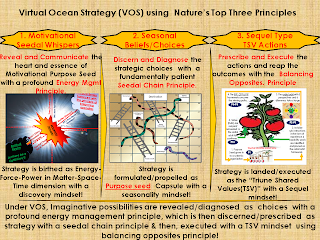

In other words, strategy under VOS is, all about serendipitously discerning the motivational seedal whisper(s) from the seasonal events, and then transforming those whispers into a seasonal choice(s), before executing them as action steps as explained in detail in the VOS article. Simply put, strategy under VOS is a seedal whisper (possibility energy) manifesting as seasonal choices (force) within the constraint of capabilities (power) by answering following three questions, in three steps as outlined in the picture on the top of the page.

- How FAR would we want to go to find our customers? – Establishing the geographical market boundaries to help answer “where to play to win” question- Scientific Force in Play – Remember Force=Energy/Space

- How FAST we need to get there, to get their jobs done? – Setting the timeline expectations to help answer “when and what to play, to win” question – Scientific Power in Play ->Remember Power=Energy/Time

- How MUCH would it take to execute this “FAR” and “FAST” value propositions? – arriving the resource or capability choices to help answer “How do we win” question – Scientific Energy in Play

- Seedal Motivation Driven Whispers

- Seasonal Beliefs Guided Choices

- Sequel type Triune Shared Value (TSV) Focused Actions

One might ask, why bother using these three principles, in the first place?

- Qualitative/Intuitive whispers (causality based whispers from serendipitous observation or by studying of one sample company or a person over a period of time)

- Quantitative whispers (correlation based whispers from historical data from various geographies)

- Intended Outcomes

- SWOTC (Strengths/weaknesses/Opportunities/Threats/Constraints) with a choice/time bound instruction manifesting from Company’s motivations w/r to competitor’s motivations (chutes) and collaborator’s motivations (ladders). For those of us who chart these things, we usually do it with five charts

- Company’s Motivation growth vs. Market Motivation Growth

- Company’s Motivation growth vs. Relative Market Motivation Share (RMMS)

- ROMCA vs. RMMS

- Motivation Margin vs. RMMS

- Motivation Velocity vs. RMMS

- SWOTC (Strengths/weaknesses/Opportunities/Threats/Constraints) with a choice/time bound instruction manifesting from Company’s market w/r to competitor’s markets (chutes) and collaborator’s markets (ladders) with a “traditional industry structure is irrelevant” mindset. Those of us who chart these things, we usually do it with five charts as listed below and also in the picture below

- Company’s growth vs. Market Growth

- Company’s growth vs. Relative Experience or Market Share(RMS)

- Operating Margin vs. RMS

- Capital Intensity (or Operating Velocity) vs. RMS

- ROIC vs. RMS

- SWOTC (Strengths/weaknesses/Opportunities/Threats/Constraints) with a choice/time bound instruction manifesting from Company’s capability w/r to competitor’s capabilities (chutes) and collaborator’s capabilities (ladders) with the “traditional industry structure is irrelevant” mindset. Those of us who chart these things, we usually do it with five charts.

- Company’s growth vs. Industry’s Total capability (Primarily Capital only for now)

- Company’s growth vs. Relative Capability Share (RCS)

- Operating Margin vs. RCS

- Operating Velocity vs. RCS

- ROIC vs. RCS

- Missteps (real vs. perceived i.e. and how it will be blown/exploited out of proportion by competitors or take advantage of us)

As we move deeper into the this step of “Discern and Diagnose”, it becomes all the more interesting -as we, now get to play the game of chutes and ladders, as guided by the seedal chain principle. Imagine for a moment – when you are inside the boundaries of this board game, as strategists we will see multiple choices, however, when we are tuned to listen to the whispers of the external events/situations (or the quantitative/correlation insights and qualitative/causal insights), the whispers (further guided by invisible instructions/test conditions), will lead us into one path more than the others, based on the expected results of the test conditions, that are established. In pragmatic terms, it is like planting a seed (time, energy, ideas, resources, insights etc) on certain sets of activities (or people) more than others, which in its due course (season), will help us to navigate into the subsequent steps, to reap the harvest or outcomes within the PURPOSE SEED Capsule.

- Return on Motivation Whisper Choice (ROMWC) is similar to ROIC variable. Simply put, ROMWC is the ratio of - no of whisper driven choices producing positive outcomes divided by all choices made in a period.

- Size of Outcome is similar to the ‘g’ variable

- Amount of threshold purpose seed energy needed to propel (or data whispers in causal and correlation dimensions) is similar to the hurdle rate(WACC) variable

- Motivational Intent gain is similar to profit variable

- Motivational value is similar to Financial value

- Motivation driven cultural value= Spirituality driven Motivation gain x (1- Spirituality driven Motivation growth/ROWCA)/ (Motivation threshold- Spirituality driven Motivation growth).

- NOPAT x (1-g/ROIC)/ (WACP-g)

- TSV= Spirituality or Emotional energy driven Motivational value (Higher Power based + Shareholder value+ Societal value (With direct linkage to SCCA in the picture above)